Scary Revelation About Australia’s Housing Crisis

By: Niro Thambipillay

February 14, 2025

Scary Revelation About Australia’s Housing Crisis

Australia’s housing crisis is insane, today I’m going to share a shocking revelation made by a major economics research firm. I’m then going to delve into some recent data to show whether what they have to say is accurate and third, I’m going to share with you how you can prepare for what’s coming for Australian’s property market.

Let’s dive in. Hello. it’s Niro here and if you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. Dire 10-year prediction for the nation’s housing crisis. Every Australian needs to read. Australia’s housing affordability crisis is expected to last another decade as construction activity fails to keep pace with population growth experts say, yep. That’s another 10 years of people struggling to find a property to live in because we don’t have enough properties in this country.

Deloitte Access Economics has painted a grim picture for Aussies in its latest quarterly Business Outlook report released on Tuesday night describing Labor’s political leadership as uninspired. While immigration has eased from record high levels, construction activity is barely keeping pace with rapid population expansion.

This means Aussies will continue to be locked out of Australia’s housing market with someone on average full-time salary of $100,000 now unable to buy a mid-price house in any major capital city. Dwelling construction activity is unlikely to get any worse, but Australia’s housing crisis is likely to last another decade, the Deloitte report said.

And while business investment was a key feature of the economic recovery after the pandemic, it has since faded. But what about Prime Minister Albanese’s goal of building 1.2 million homes, that’s 240,000 homes, Every year for five years up to 2029. Well, the latest construction data paints a shocking picture.

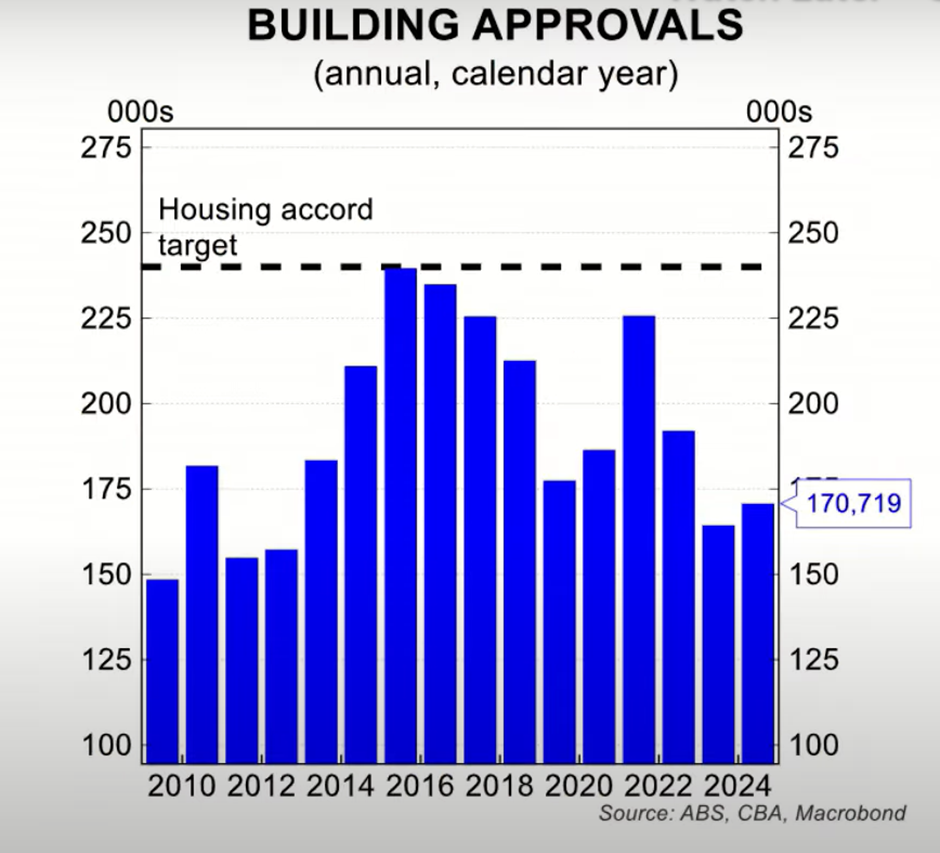

Australia misses first year housing target by more than 68,000 dwellings. Building approvals across Australia have fallen significantly short of government targets. With new data showing a 29% shortfall in the first year of the National Housing Accord. Australian Bureau of Statistics data analysed by money.com.au revealed only 171,394 building approvals were granted in 2024, well below the annual target of 240,000 needed to deliver 1.2 million new homes by 2029.

The shortfall means Australia now needs 276,994 building approvals annually over the next four years to meet the government’s target. How likely is that to happen?

I’ll come out and say it’s just not going to happen. We will not meet these government targets. Money.com.au property expert Mansoor Sultani said Ongoing industry challenges were hampering construction efforts, supply constraints, rising material costs and planning delays continue to hold back construction and development in Australia. Without meaningful reforms to fast-track approvals or ensure builders can afford to ramp up projects.

The gap between housing demand and housing supply could widen even further. Mr. Sultani said. Now, in some sort of good news despite missing the target, building approvals increased 10% nationally in the second half of 2024 compared to the same period in 2023. When we look at the actual data from the Australian Bureau of Statistics,

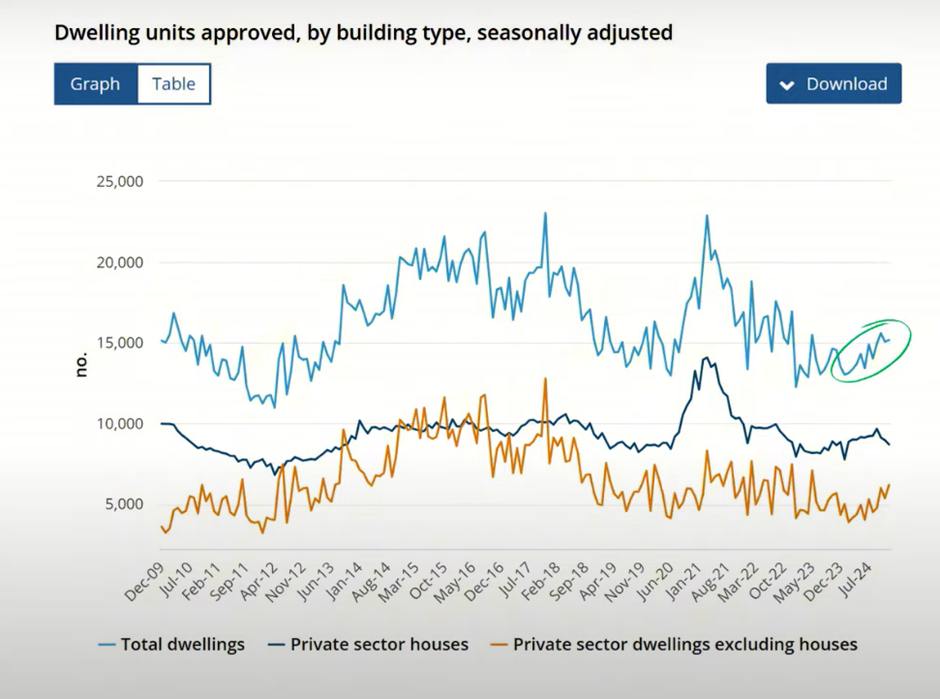

We can see that yes, total dwellings approved has increased. That’s the light blue line on the top there. But when we look at how that’s made up, what you can see is that increasing because private sector dwellings excluding houses. So, we’re talking about attached dwellings like apartments, etc, they are increasing, but that dark blue line in the middle that’s talking about private sector houses, that’s actually falling.

So, we’re not building enough houses. Yes, construction might be improving because of the increase in apartments, overall, we’re still so far short of target that we are in a housing crisis for at least another decade according to Deloitte Access Economics. If we look at this following chart from Harry Otley,

It shows the wide gap between dwelling approvals and the government’s housing target. You can see the housing accord target should be sitting at 240,000. We’ve actually never really reached that target. The closest we got was back in 2017, but as you can see right now, we’re so far below that at only 170,719. And this next chart paints a really clear picture about how bad our housing crisis is-

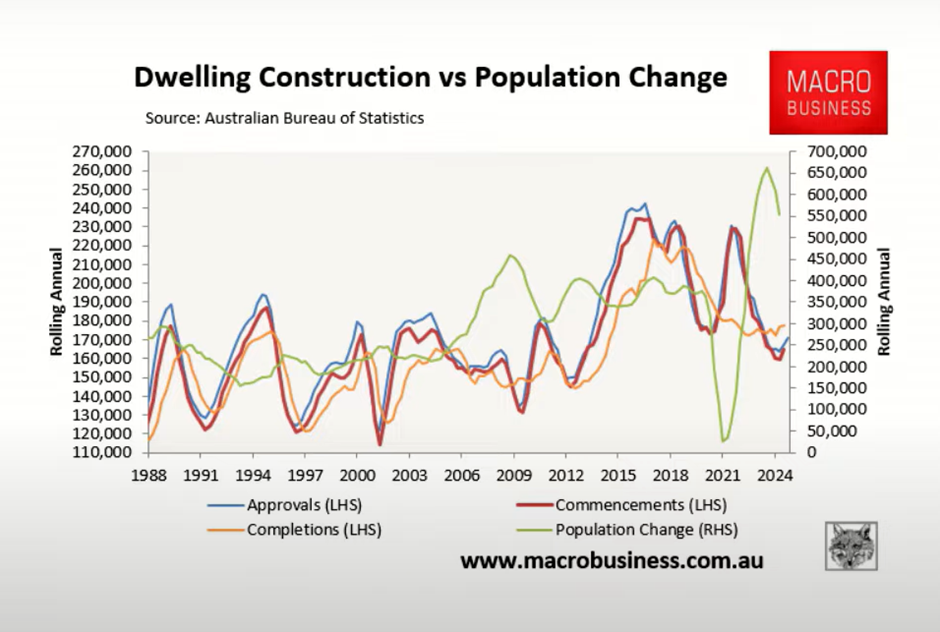

You can see the green line. which is talking about population change. Yes, it might’ve dipped from its peak, but it’s still well above long term levels. And yet look at where construction levels are really, really low compared to the growth in our population. So that only shows that demand is rising far more than supply.

So, the question then is. What does this all mean for property prices? Now, many people will say, Oh, look, well, if housing affordability is falling, and there’s no doubt that with where prices are, affordability is at the lowest it’s been at in recent memory, people will say that means that property prices have to fall.

But with the housing crisis that we have, what they forget is that when demand is higher than supply, prices need to rise. So then how do you reconcile the two. Well, if we look at just some simple numbers here just to highlight the situation, if we have 100 potential buyers for 100 potential properties, prices stay roughly the same.

But what happens if we have 130 potential buyers? For 100 properties, well then it will be of that 130 buyers, it will be the 100 who can afford the highest prices, who will get the 100 properties, thereby driving the prices of properties up. That’s why when you look at the affordability indexes and charts that people throw out there, especially in the mainstream media, they might be looking at it like in this example on the affordability of the 130 people who are looking to buy properties, but.

That’s actually not accurate because what you need to look at if you’re looking to make a decision about which way property prices will head You need to look at it from a demand and supply perspective You need to look at it to go. Okay, there’s only 100 properties and then these 100 potential buyers What’s their affordability like can they afford where property prices are, and the data shows that they can.

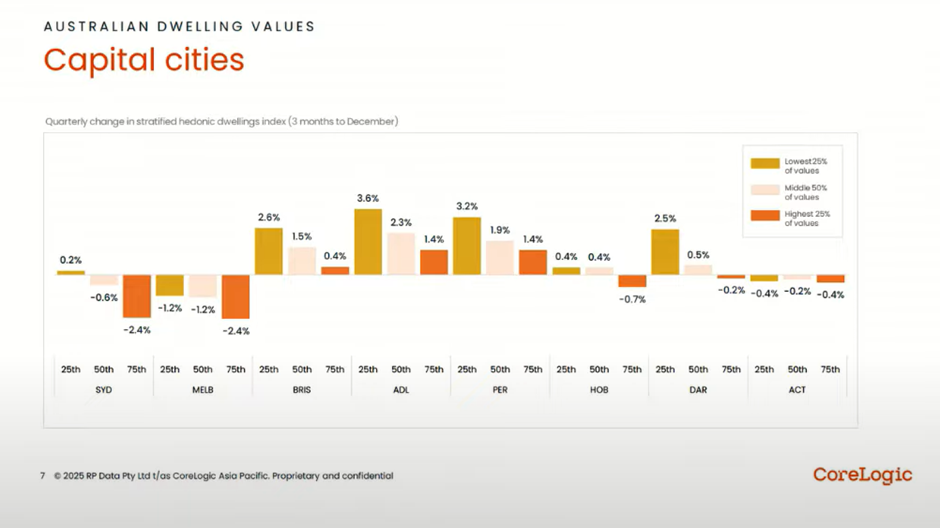

That’s why property prices at the moment are generally flat across the board but tipped to rise. However, here’s the other thing to consider. When we look at this chart from CoreLogic,

Looking at Australian dwelling values for just our capital cities, what you can see is that in Sydney, although Sydney property prices are starting to fall slightly, the cheapest quartile, the lowest priced 25% of properties, which is at furthest left line, is slightly above zero.

It’s starting to rise slightly. Melbourne, okay, negative across the board. But again, look at the difference in the price falls. It’s the most expensive end of town that’s falling the most. The cheapest 25% and mid-range 25% aren’t doing as badly.

Then when we look at our smaller capital cities, like Brisbane, Adelaide, Perth, where they’re all rising in general, you can see that it’s the lowest priced 25% of properties that’s rising the most. When interest rates do fall I expect this is only going to continue because of affordability constraints, you’re going to have more people competing for the lower end of town in many of these areas. Which means that those properties will rise and probably will rise first. They’ll get to a level where then people go Oh but if I just spend a little bit extra now, I can go into say a mid-range type of properties. Then that segment of the market will take off.

So essentially what this housing crisis says is that many people will not be able to find a property to live in or even to rent for the next 10 years, which is a disaster for this country. But it also shows that in general property prices and property rents will keep rising no matter what until this housing crisis is fixed.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.