Australia’s Housing Downturn has ended | What next for property prices

By: Niro Thambipillay

February 14, 2025

This could be the shortest downturn in the Australian housing market in history. Today, I’m going to share with you some astonishing data, which shows how resilient the Australian property market is. Why all those negative headlines that we saw at the start of this year have already been completely wrong. What the key factors are that support property prices rising in 2025.

Hello, it’s Niro here. If you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. The surprisingly short downturn. Australia’s housing market has staged a remarkable recovery in January 2025, bouncing back to growth after just One month of price declines, and this is from Nerida Conisby, chief economist at Ray White.

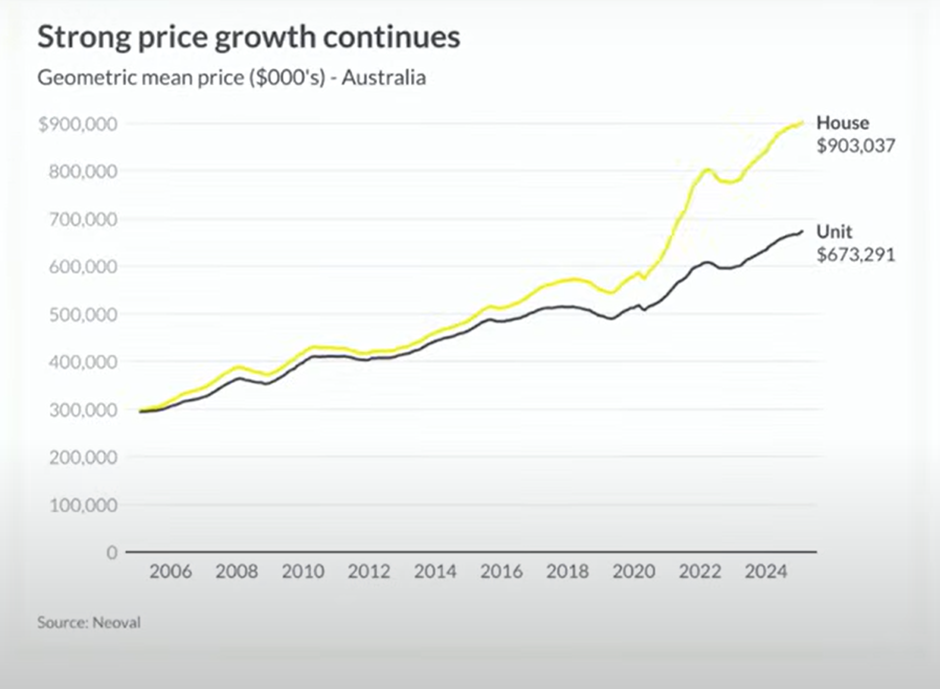

This swift reversal could potentially rank amongst the shortest market downturns on record. And when you look at this chart,

where the yellow line is looking at housing prices, and the black line is looking at unit prices, you can see at the very end here, which is talking about the last month, those lines are starting to blip up.

So, the data is showing that across Australia, In general, property prices are starting to rise again, but not equally. When we look at this next table,

produced by Miss Conisbee, what we can see here is that last month, Perth prices grew 1.1%. Adelaide, Brisbane, Gold Coast, and Sydney were all also very, very strong. But then Darwin, Canberra, Melbourne Not very strong at the moment.

If we look at the regional markets, we can see that again, regional wa, regional South Australia, regional Queensland and regional New South Wales are all growing in value again, on average. That doesn’t mean that all the regional markets in those states are rising in value, but on average they are.

However, regional Northern Territory. Regional Victoria still somewhat struggling. Now, if you’re surprised that the housing downturn was so brief, well, we need to look at what history shows us. And according to history, the Australian property market has always been quite resilient.

House prices never fall very much in Australia. Even in the recessions of 1982 and 1991, they only fell 6.2%. And in the past 50 years, the national median price has only fallen more than 10% once, 10.2% after the APRA crackdown on lending to property investors in 2017, which says a lot.

In total, there have been eight housing downturns since 1980 averaging 6.7% including the current one. Housing is the market that never crashes. It only gently subsides. And the current fall in prices looks like being the smallest and shortest in living memory. Even though it’s caused by one of the biggest declines in household disposable incomes in history and comes in the midst of a national project to make housing more affordable. The median capital city price peaked in November and has since fallen less than 1%.

So why have housing prices started to rise again so quickly? Well, there are a number of factors. First, let’s have a look at what outgoing Chief Executive of the REA Group Owen Wilson had to say.

Financial markets may have locked in a Reserve Bank rate cut only in the last week following softer than expected inflation numbers, but Wilson says the cut had already been factored into housing markets. If you’ve been buying in the last five months, you would be pretty confident that your next rate move is down.

So, we’re already getting the benefit of the rate cut before it even happens on the buy side. The prospect of more RBA rate cuts. Pent up demand for housing and seller confidence should keep the market in a strong state for at least this calendar year, Wilson says. And Ms. Conisbee echoes these sentiments.

The resurgence appears to be driven by several key factors. Most significantly growing expectations of an interest rate cut have boosted market sentiment. This anticipated monetary easing would increase buyers borrowing capacity and reduce mortgage payments for existing homeowners. Market confidence has also been bolstered by these positive rate expectations.

Additionally, a seasonal reduction in new listings combined with more cautious seller behaviour has created tighter market conditions. Once interest rates do decrease, we could see a rapid shift from the buyer’s market experience in late 2024 to conditions favouring sellers. But then you might be wondering, is this just another short-term fluctuation? Are property prices dropping one month, rising one month, and then maybe falling again in the, in the future?

Well, Ms. Conisbee addresses that as well. For those hoping for more affordable housing, the outlook long term suggests continued price growth, albeit with occasional brief periods of decline. This trajectory is primarily driven by a persistent structural undersupply in the Australian housing market.

We appear to be experiencing a fundamental shift in the property markets dynamics, where traditional cycles of significant ups and downs are being replaced by sustained long term price growth interrupted only by brief corrections. The supply constraints facing the market are multifaceted and deeply entrenched.

The construction industry is operating at capacity while decades of undersupply have created a significant construction backlog. This is compounded by a fundamental mismatch between available housing stock and shrinking household sizes. Construction timeframes have permanently extended and the industry faces workforce challenges.

These structural constraints effectively create a floor for housing prices and limit the potential for significant price reductions. So, what that means is we have a property market right now where, because we don’t have enough properties for our rapidly growing population, property prices will continue to rise.

The long-term trajectory will be upwards. Yes, there may be brief periods where the market takes a bit of a breather and I’ve been saying this for a while that what we saw in December and January was just a breather for the market. Essentially, the market will continue upwards because of the supply shortages that we have in this country and fixing those supply shortages is not something that’s easy to do.

This has been a problem that’s been brewing for decades. And although certain markets around the country haven’t yet started their next upturn in the property cycle, there is still a lot more optimism in many areas around Australia. Two-bedroom home jumps reserve by more than a million dollars as auctions pick up.

An original condition, 2 bedroom home on Sydney’s lower North Shore sold for more than a million dollars above its reserve at 5.8 million dollars. As auction results pushed above 70% in the city, the New South Wales capital clocked a 73% preliminary clearance rate up from the previous week’s 67.5%, according to CoreLogic data.

Now, of course, properties at these prices are not affordable by the average Australian. So, does that mean that you discount them in terms of working out what’s happened to the property market? Actually, no. Have a look at what CoreLogic have to say. In today’s Pulse, Head of Research Eliza Owen explores the area’s best place to benefit from expected rate cuts.

She says, certain markets will see a bigger boost from rate reductions than others, and it may be because of market characteristics like price point, location, and investor interest. CoreLogic estimates, based on previous periods of rate reductions, that national dwelling values would increase an average of 6.1% for each one percentage point decline in the cash rate. Now that’s average what that means is some areas won’t even rise that 6% while other areas could easily do 10% or more in capital growth.

Relatively expensive markets have historically shown stronger responses to reduced cash rate settings. A reduction in the cash rate could spur a recovery trend in the high end of the Sydney and Melbourne housing market, which tend to be the bellwether for broader market recoveries in those cities. So, what she’s saying is that when you see more expensive properties start to move more quickly, that filters down to the more median price properties in certain markets.

And although she’s talking about Sydney and Melbourne, that’s probably one thing I would disagree with here. Yes, I think those markets will be positively affected by interest rate cuts for sure. But I think markets like Brisbane, for example, which is now more expensive than Melbourne will see an equal, if not greater property market uplift from interest rate cuts and with some of our other smaller capital cities like Adelaide or Perth or with some of our larger regional markets. You’re going to see interest rate cuts spur on activity in those markets as well because they have almost an even greater chronic undersupply of properties as people have moved into those areas due to affordability reasons.

So ultimately the key takeaway, simply this, the property housing downturn, if there really ever was one is now over. Prices are starting to rise across multiple areas around Australia. And if you can afford to the data clearly shows that buying a good quality property in the right area sooner rather than later will definitely put you ahead financially.

And if you want help to work out, well, where are the best places to buy an investment property, check out the link below to get total for free the audio version and digital version of my book here.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.